Suddenly we all asked ourselves why some parts of society are able to use these legal smokescreens to cheat the system and squirrel away money that could otherwise be spent schools and hospitals. And pretty soon after, most of us asked what we can we do to prevent it?

At Global Witness, we think there are solutions. We’re calling for governments to shine a light on this murky world by requiring the real or ‘beneficial’ owners of companies to publicly declare their identity. That would stop the criminal and corrupt being able to hide their activities behind the kinds of fake companies that cropped up time and again in the Panama leaks.

There’s already been significant progress – take a look here for more on that. But it’s not just about governments changing what they do – multinational companies making vast profits often take part in dodgy deals and cover up profits through anonymous companies, and that needs to change too. This is especially true of the oil, gas and mining sector, synonymous for so many years with the corruption that stifles developing economies and props up brutal, state looting regimes. Now, there are real opportunities for reform here too, as a new briefing paper we’ve launched today with the Natural Resource Governance Institute looks at in Myanmar - more on that below.

Corruption in the oil, gas and mining industries

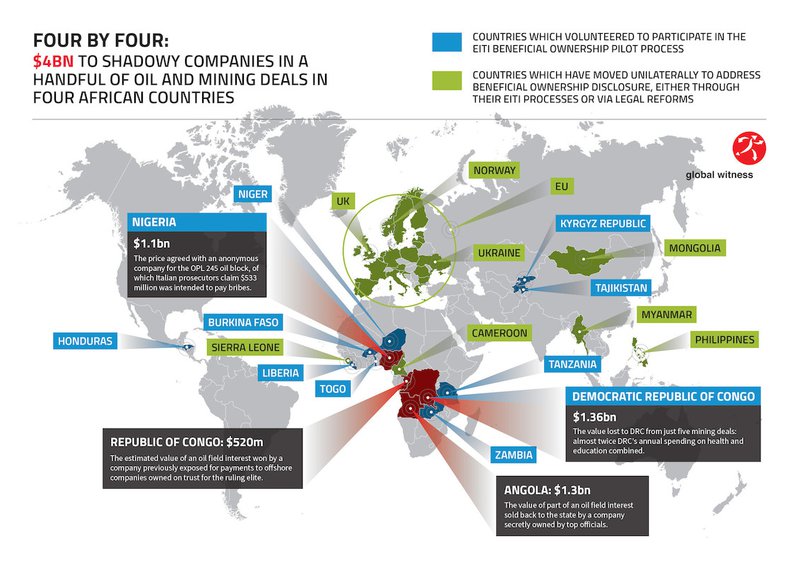

Our report How to lose $4 Billion revealed how vast oil and mining assets have been handed out to companies whose real owners are unknown, by governments with poor governance records like Nigeria, Democratic Republic of Congo and Angola. In a fourth country, Republic of Congo, a company whose beneficiaries remain uncertain but which has historical connections to high ranking public officials, received lucrative stakes in several oil fields. Take a look at this graphic:

The risk that these vast sums of money are ultimately going to a corrupt official is stark, and this is not a victimless crime. It costs lives and livelihoods by depriving states of revenue that should be spent on education, health care and basic services for some of the most impoverished people on the planet. In one deal in Nigeria, involving the oil giants Shell and Eni 1.1 billion dollars – equivalent to 80% of Nigeria’s proposed 2015 health budget – went to a company secretly owned by the former oil minister instead of benefiting the Nigerian people.

So, what is the world doing about this? Well, quite a few things. In March, after a huge campaign by transparency NGOs such as Global Witness, Publish What You Pay and NRGI, the global Extractives Industries Transparency Initiative (EITI) agreed to a ground breaking new provision that all companies who bid for, invest in or operate oil, gas and mining assets in all of its 51 member countries will need to disclose the real natural people who own or control them by 2020. Member countries will need to have set out a plan of action for achieving this by January 2017.

This is a huge step forward for greater transparency and accountability in the sector, but it will only be as good as its implementation. EITI stakeholders such as the 51 member governments, international and national civil society, companies and donors such as the World Bank, UK, US, Norway and Australia will need to work together to properly implement these reforms if they are to bring much needed change to lives of people in resource rich countries.

Myanmar, secret company ownership and corruption

As our new briefing shows, Myanmar is a stark example of many of these issues. As it emerges from over half a century of military dictatorship, the country’s famed natural riches are still in the grip of the powerful elites who pose the greatest risk to reform and peace. Nowhere is this more clearly shown than in the jade sector.

Myanmar’s 2014 jade production is estimated at up to U.S. $31 billion – 46 times its government spending on healthcare. As our report, Jade: Myanmar’s “Big State Secret”, the industry is controlled by the country’s most notorious army figures and drug lords, who use hidden company networks to cover their tracks and escape scrutiny. Their activities have torn apart the landscape and triggered deadly landslides which have caused hundreds of deaths and injuries. So, an industry which could be key to achieving progress and development is instead enriching the greatest threats to reform, posing a serious obstacle to real change, stability and peace.

Myanmar’s new civilian-led government recognises the risk posed by the corruption at the heart of its extractives sector, and has started a much-needed overhaul. Opening up the beneficial ownership in line with EITI requirements is essential for Myanmar’s people to see who is really controlling their country’s most valuable resources.

Seven steps to ensure effective beneficial ownership reform in Myanmar

To assist in this process Global Witness and NRGI have today released a briefing, putting forward seven steps Myanmar needs to take to properly implement the EITI beneficial ownership rules.

1. Set a strong beneficial ownership definition including outlining who is not a beneficial owner of a company and ensuring so-called politically exposed persons disclose their identity.

2. Agree on identifying information for beneficial owners - It is essential that there is sufficient accompanying information for the identity of each beneficial owner to be pinpointed, and for the nature of his or her interest in the company to be fully understood (i.e. full name, identifying details, means of control etc)

3. Agree on scope of disclosure in the short and long term – ensure wide coverage of all relevant companies in the sector.

4. Establish mechanisms and timeframes for data collection – a clear process and timeframe will ensure companies are clear when and how they should be reporting.

5. Find a workable method for confirming information – including requiring companies to attest to the accuracy of the information and provide documentation to back this up, cross-checking the information against available documentation, performing deeper audits etc.

6. Publish information in an open data format - make the beneficial ownership declarations coming out through the EITI process fully accessible to the public so that anyone looking into the extractives sector or a particular company’s activities can review and use them easily.

7. Commit to improving extractive sector governance - multiply the benefits of new beneficial ownership information by combining it with other public resources for the purpose of investigations or due diligence.

These seven steps are a useful guide to civil society, governments and companies in other EITI countries as they implement the new beneficial ownership rules.

Standing up to powerful political and vested interests

The extractives sector is still one of the most corrupt industries on the planet - according to the OECD roughly 1 in 5 cases of transnational bribery occurs in the sector.

As the world is now waking up to the links between company secrecy and financial crime, there is a chance for this sector to make big strides with the right reforms. The EITI is in an excellent position to help deliver real positive change for citizens in some of the world’s poorest countries, but it will take leadership, cooperation and determination.

The same vested interests that want to preserve a secretive, unjust and unsustainable status quo in Myanmar want to see the EITI fail because they stand to lose out from the global push for transparency. And the same is true in many other resource rich countries as Global Witness investigations and case studies continue to show. Companies, governments and civil society need to work together to implement these reforms by taking the seven steps identified above and truly commit to improving governance in the sector so that is working to further the public interest and not continuing to enrich powerful vested interests.